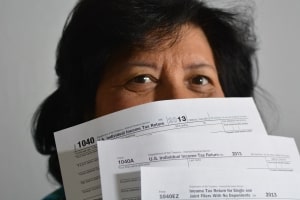

Deducting Bad Debts

A loan is one such thing, which in today's world, is quite hard to get especially for people with low income. While for some, it works out great as they pay it back quite soon to lease off the burden, others suffer to repay it back. Bad debts refers to when you are not [...]